Financial services

401K/IRA Rollover

Understanding retirement options can be challenging. Whether you have a 401K or want to roll over your retirement to an IRA, our licensed financial professionals can help you decide the best option for your retirement needs.

Life Insurance

We never know when the unexpected will happen. Life insurance provides financial protection to your loved ones in the event of your death. There are various types of policies, each offering different benefits and features to suit your needs.

Long Term Care

Getting older is inevitable and there may be times where extra assistance is needed. Long Term Care provides financial protection for individuals who may require assistance with daily activities due to chronic illness, disability, or aging.

College Plans

The cost of education is on the rise. College planning involves saving and investing money to cover the costs of higher education for yourself or your children. Various investment strategies are available to help families prepare for future educational expenses.

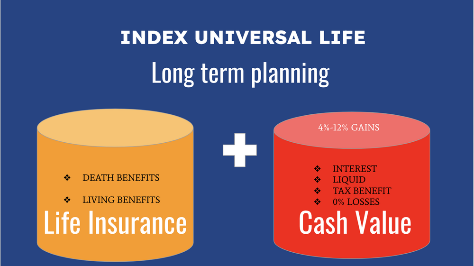

Index Universal Life (IULs)

Having the flexibility to have insurance coverage and cash value is important. IULs are permanent insurance policies that offer both a death benefit and a cash value component. An IUL policy’s cash value grows based on the performance of a chosen stock market index, offering the potential for greater returns compared to traditional universal life policies.

Fixed Indexed Annuities

Looking for an investment that offers growth and protection? Fixed indexed annuities offer a guaranteed minimum interest rate combined with the potential for additional interest based on the performance of an underlying market index. They provide a balance of principal protection and growth potential for retirement savings.

Executive Bonus Plans

Seize the opportunity to elevate your leadership and secure your financial future. Executive bonus plans are designed to provide additional compensation and retirement benefits. Employers pay premiums on a life insurance policy owned by the employee, serving as a form of supplemental income and retirement savings.

Legacy Planning

Your legacy is more than just wealth—it's a testament to your values, passions, and aspirations. Legacy planning involves creating a strategy to preserve and transfer wealth to future generations while minimizing taxes, maximizing control over assets, while ensuring that your wishes are carried out and your legacy is protected.

Living Wills & Trusts

Empower yourself with the peace of mind that comes from knowing your legacy is protected. Living wills and trusts allow individuals to specify their healthcare, medical treatment and distribution of financial assets in the event of incapacity or death.

“Nellod Financial is easy to work with and my licensed financial professional is very quick to respond when I have questions.”